Engaging Advisory Clients Through Mobile App Technology: Raising The Value Of Financial Advice in 2022

Modelling a client's household financials and future scenarios is a critical tool for financial advisers. Capturing an accurate baseline with real-time data and developing robust projections provide the solid foundations of financial planning. The single most important mathematical equation in financial advice is to calculate a client's assets, liabilities, income & expenses to meet their changing life events and goals over time.

Most financial planning software and spreadsheets use a traditional linear approach to modelling and this often leads to gaps. Until recently, limited computation power meant more complex modelling was virtually impossible. Most financial planners are moving away from spreadsheets, adopting a digital strategy. Today, modern financial planning software is taking a more multi-dimensional approach to modelling, using algorithms and real-time data behind the scenes, with a quality, more meaningful client-facing experience.

How Financial Planning & Analysis has progressed?

Financial planning is dynamic, so advisers modelling software should be as well. Speed, performance and scalability of financial modelling, behind a great client-facing user interface (UI) is what today's consumer demands and the industry needs to adapt towards this.

When a client seeks financial advice, they want answers to their problems in real-time. They want to understand how different decisions impact their future. Delivering advice this way shifts the value of advice from the back office, to the front office, creating a better client experience, transparency and greater efficiencies within the advice process.

How you can improve your FP&A professional service?

What do we call this type of sophisticated modelling that utilises actuarial, cloud-based technology? We've labelled it multi-dimensional modelling.

What is multi-dimensional modelling?

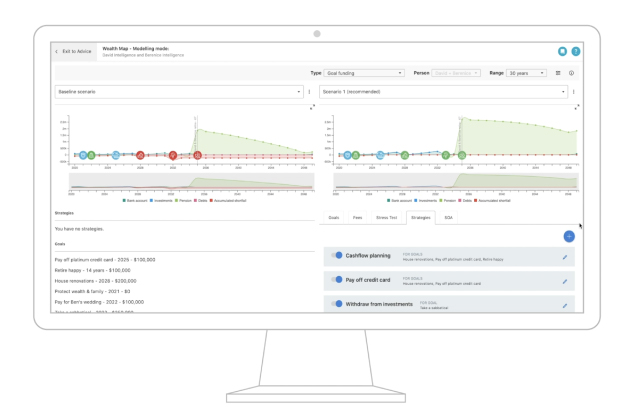

Essentially, multi-dimensional modelling helps advisers to visually demonstrate, live in front of a client, how their advice bridges the gap from where the client is positioned today, to where they want to be in their future, with their "goal achievability" as their core outcome.

Multi-dimensional modelling demonstrates the various scenarios a client can take. A scenario is a projection made up of a combination of a client's goals, assets, liabilities, income & expenses, insurance, economic factors and strategies over their life expectancy time horizon. It is ever-changing and requires review.

This type of modelling projects the client's goals, assets, liabilities, income & expenses in today & future value, it matches funding sources (eg: assets, lump-sum cash and cash flows) to be available at specific times in the future, including funding of future goals. It uses funding capital and liquidity to draw funds from different assets, investments, cash, debt or equity to fund new investments or goals, it can model future savings or future withdrawals to fund a home purchase or a deposit, or to create an emergency fund. It can also model funding for retirement optimising returns, super contributions and pensions. It can also link strategies to the actual product research to support recommendations and meet compliance obligations.

The power and intelligence of multi-dimensional modelling adds trust and confidence to the industry, it makes analysis and decision making faster, and it evolves financial planning into a realm whereby consumers can widely understand the importance and value of advice, in particular how it can help them achieve their life outcomes.

The use of real-time data for modelling

No one makes money from being compliant, compliance will always cost licensees on their bottom line, which is why automation needs to be a focus as more regulatory layers are added to the advice process.

RegTech provides financial firms with a solution to automate their manual advice processes, access their data centrally and digitise. By minimising the time it takes a licensee to access advice recommendations and SOAs for audits, including client data across all their authorised reps at scale, compliance professionals can respond more accurately and efficiently when faced with an enquiry. This brings about transparency across the entire value chain, from regulators to licensee management, through to the consumer.

Exploring RegTech Elements

Financial plans should be constantly updated with data to gain a clear and accurate picture of how a client is tracking toward their life goals. However, traditional financial plans are most often paper or PDF documents, static and unable to be populated with data.

Data as a Service (daas) such as investment and bank account transactions via APIs, can provide a more accurate position of a client's investments and cash flow. By leveraging new technology that's transitioning traditional financial plans into a live, digital, mobile-app experience, means financial advisers can enhance their service offering by delivering a more dynamic alternative, aligning to the way today's consumer interacts via app-based technology. Notifications and alerts can also provide warnings to when their clients are on or off track from meeting their goals, helping advisers to proactively manage their client's investments and cash flow toward a measured outcome.

Real-time data also has the benefit of auto-populating modelling and projections. As daily data updates a client's balances, the model automatically runs to update the projections. This gives advisers the flexibility to modify their client's plans to reflect constantly changing markets, life events and their client's goals.

How AI can improve your Financial Planning & Analysis as a professional service?

The application of Machine Learning can be looked at the same way as it's being applied to the driverless car industry. There will be different levels of advice automation over the coming years, which will transform the way financial planning is delivered and experienced by consumers.

The way we see Machine Learning (ML) in financial planning is that big data will grow and enhance optimisation capability. Modelling, via Machine Learning, will learn over time the combinations of different strategies that will help to self-determine an optimal scenario, "people like me scenarios" that will assist advisers in recommending advice that puts their clients in a better position in relation to their goal achievability.

Machines can run thousands of permutations of various outcomes, all within predetermined compliance parameteres, with more computation power than the human brain, so this technological assistance will make advice more accurate, efficient, scalable, affordable and accessible.

The breakdown of how we will see automation applied can be summarised below:

Level 1: minimally automated

Most AdviceTech today is minimally automated, whereby most functions of an adviser and paraplanner are manually controlled. Financial modelling and calculations are mainly linear, driven by excel spreadsheets via a user interface that requires a lot of manual data input, with little visualisation that's client-facing. Whiteboards are still used to demonstrate advice strategies, client's goals aren't able to be modelled and financial plans are presented to clients as PDF's, PowerPoints or paper documents. Compliance is labour intensive due to multiple data sources, client files and advice isn't easily accessible or centralised for auditing.

Level 2: semi-autonomous

Technology like advice intelligence has semi-automated the advice process, taking paraplanning from the back-office into a client-facing modelling experience so that advisers and paraplanners can explore various scenarios directly with clients. This sophisticated modelling can run any mix of client goals, assets, cash flows, strategies, economic and regulatory parameters to model scenarios in milliseconds.

Data flows from the digital fact-find into the CRM, modelling tools and product comparators. All advice scenarios are centrally stored digitally so that advisers and compliance departments have instant access. The client's goals are linked to advice strategies & products to ensure best interests is built-in. This automation is driven by a client’s needs, aspirations and trade-offs and is enriching the advice experience.

Level 3: autonomous

The future of AdviceTech will be a 'human centred' digital experience, collecting live client investment & account data from authorised open banking sources via a mobile app that will automatically determine the actual position of the client. This technology will identify meaningful patterns from larger data sets, extracting insights to build what-if scenarios that will enable tech-driven advice practices to forecast future outcomes for clients in an autonomous way.

The software, optimised via modelling engine algorithms learned over time, identifies the most optimal scenario for a client creating a combination of their goals and recommended advice strategies, modelled within a compliance framework, to achieve the client's desired life. It learns constantly off live data, client cash flow habits, behaviours and investment bias' and assists advisers to focus on the relationship and behavioural coaching aspects of financial advice, ensuring their clients stay motivated and on track.

The future of planning leveraging the latest AdviceTech is exciting for today's advice practice. Adopting a future-proof solution that has a clear pathway toward automating your advice process, that allows your advisers to spend more time nurturing and attracting more clients, will create more opportunity, growth, and profitability for your advisory firm.

If you want to see this technology demonstrated, click to Book A Free Demo now.