Due to the current state of regulation which has imposed layers of barriers that sit between advice providers and consumers, there's an enormous horizon of opportunity ahead for this industry. Following Michelle Levy’s Proposal for the Quality Advice Review, I am optimistic that we may be steps closer to delivering affordable digital advice in a way that’s aligned with the way people consume products and services in our modern, smartphone age.

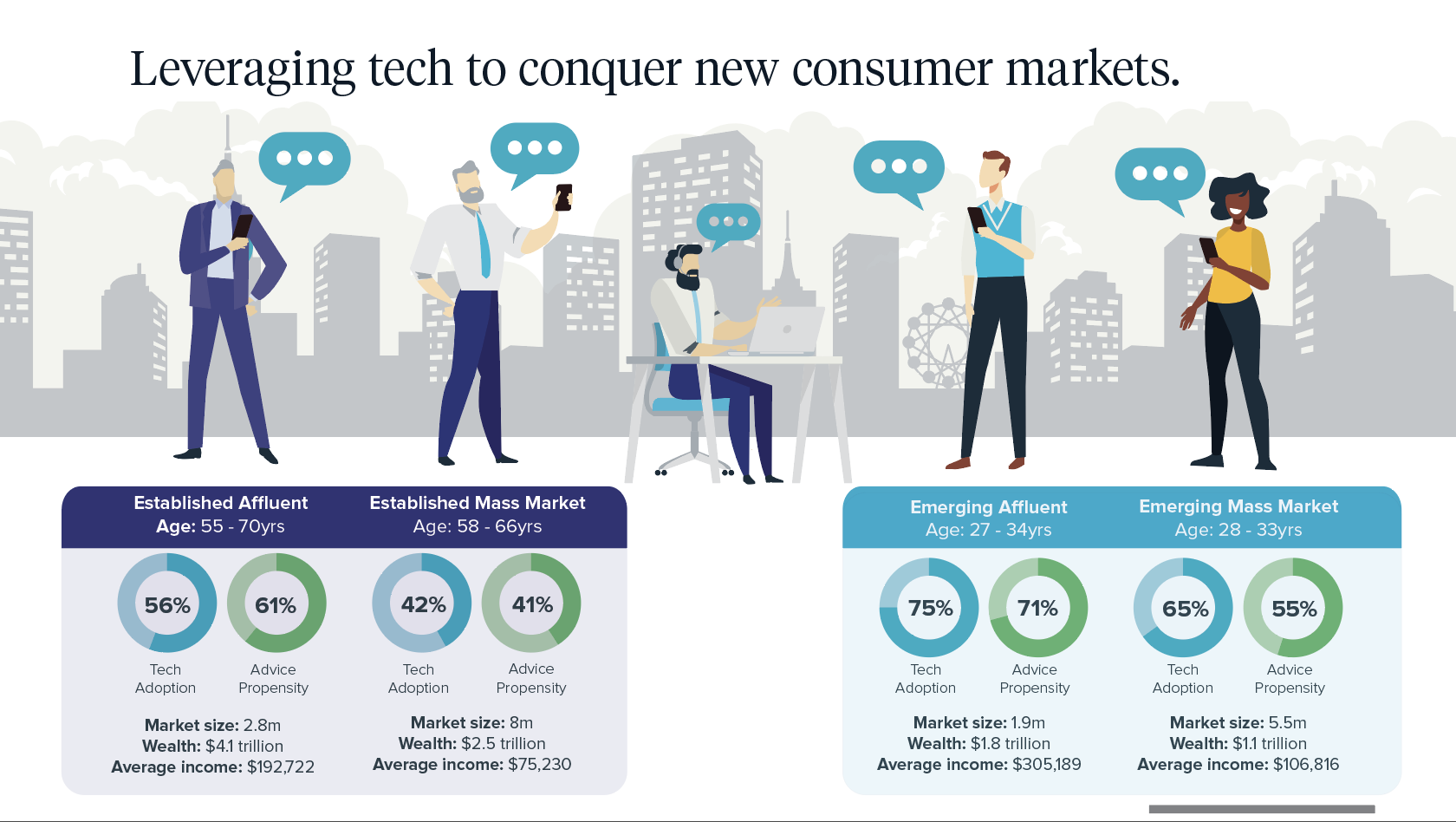

The last reform regime resulted in a mass exodus, leaving only 17,044 advisers to service a growing 7.4 million market, comprised of 'emerging mass' and 'emerging affluents', who earn between $106-305k p.a. and have a 65-75% propensity to adopt digital advice. Between 2021-2027, we will experience peak years of baby boomer cohorts approaching retirement, who are fitter, healthier, and more tech-savvy than ever before. There is no doubt that digital financial advice is the market to be in.

To bridge the widening gaps between advice and consumers, and dismantle the walls inhibiting both technological innovation and the emergence of business models that support the actual purpose of the regulation, it was essential for the Quality Advice Review to explore substantial change. We must pave a new path for our industry - one that simplifies the complex laws governing advice. I applaud Michelle for listening to the voices in our space, conducting her review in a collaborative forum, and taking a firm stance.

Today, regulation has been focused on disclosure, education, best interests, and remuneration, with PDSs, FSGs, and SoAs supposedly positioned to help empower consumers. Despite these regimes being introduced with the intention to assist the cause at hand, they certainly have not met the objective of supporting consumers in making well-informed decisions around their finances.

In fact, the effect has been quite the opposite and consumers are more confused than ever before. The imposed delivery mechanism of advice designed around a static paper-based SoA bears much complexity, it is left unread and simply not understood by clients. Not only this, the advice process itself has continued to pile on layers of friction, adding additional steps to the process, rather than detracting.

Michelle makes a critical point: “Consumers want good advice – not documents and processes, " focusing on the “consumer and the advice rather than on the provider and the process for formulating the advice.”

In response to the review, I provided my own submission entailing the future digital advice model. Following this, I was given the opportunity to take part in a round table discussion last week, a dialogue that involved a number of digital advice leaders, including Michelle Levy, and members of Treasury. Below, I provide an overview of the proposed regime as well as my response to the review. I note that whilst there were a number of B2C digital advice providers present during this round table, like Stockspot, Sixpark, Ignition, and Abrdn, I was perplexed by the lack of representation from any other B2B AdviceTech provider, such as IRESS, Midwinter, or Adviserlogic. In my opinion, this demonstrates a lack of engagement and support towards the future advice model in this country during a time when the future has never been so important.

Moving into a world of Good Advice

The aim of the proposed Good Advice duty is to remove unnecessary regulatory requirements relating to disclosure and conduct. In turn, these changes in the law should encourage the opportunity for innovation, principally around the delivery mechanism and quality of advice, so it can be distributed in a form of the providers choosing, and designed around the way today’s consumer wants to engage, interact and consume advice.

With years of evidence clearly indicating that SoAs do not hold the true value of advice for most consumers, and with the traditional advice industry placing so much emphasis on the value resonating in the form of an SoA document, it is precisely this disconnect I hope we can solve through the simplification of laws within our evolving advice profession, to ultimately uplift the consumer experience.

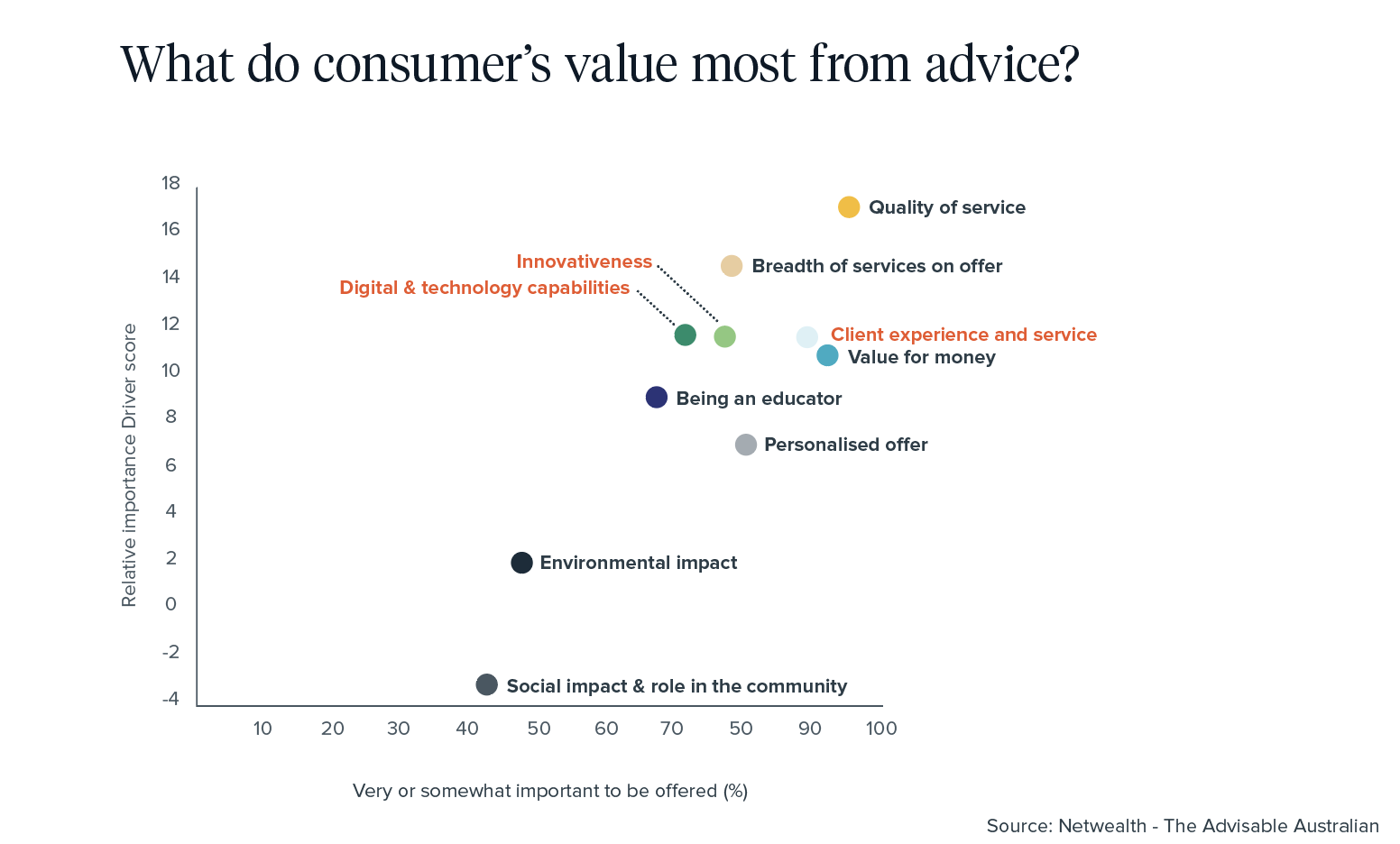

Our extensive research discovered little value is placed on SoAs, but actually held within these six main attributes for consumers:

- Exploring potential possibilities for their future

- Solving their specific problem/s

- Achieving their life dreams & goals

- Transforming & improving their situation

- Making informed life decisions

- Coaching their mindset, behaviours & keeping accountable

The Good Advice duty, I believe, can allow for more innovative and consumer-centric ways of delivering financial advice, that is more flexible for both the advice provider and consumer.

However, there’s a contrasting effect I will highlight. Good Advice clearly aims to solve the issues of making advice available to a broader mass market or consumers who simply require a particular problem to be solved, which tends to fall into the category of ‘scaled’ advice. In the example of a consumer that requires help with superannuation contributions or rolling over funds, these consumers tend to contact their existing provider for this advice and don’t necessarily need an adviser in this instance. The current regulatory framework makes this a complicated process for the consumer and the superannuation provider, and the proposed changes aim to remove the unnecessary layers, with the outcome to improve the accessibility and affordability of this type of advice.

Relaxing regulation also comes with a balance of ‘quality’ of advice. As a digital advice provider that prides itself on the philosophy of commencing the advice process with the client’s life aspirations & goals, advice strategies, and then product recommendations, the changes proposed do revert us back to a product-first methodology. Upon raising this point during our round table last week, Michelle answered that best interests requirements would remain a part of the Good Advice framework, specifically, indicating that the advice needs to “reasonably benefit the client”, and the advice provider has a duty twice under the current Corporations Act. Her argument also refers to this point “the greater the risk of harm, the more work a provider will need to do to be satisfied they are in fact providing good advice”, thus there are enough regulatory guidelines to roll back to for consumer protection.

What are the proposed changes?

|

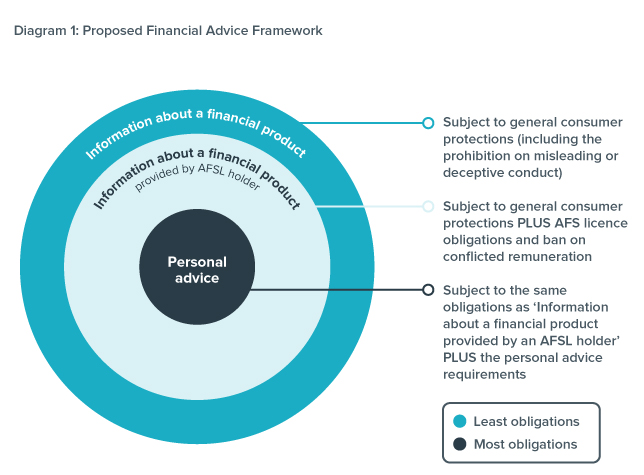

Proposal: Regulation of Personal Advice The financial services regime should regulate the provision of ‘personal advice’. ‘Personal advice’ is a recommendation or opinion provided to a client about a financial product (or class of financial product) and, at the time the advice is provided, the provider has or holds information about the client’s objectives, needs, or any aspect of the client’s financial situation. Outcome: This proposal is aimed at reducing regulatory complexity and enabling advice providers to provide more helpful guidance and financial advice to their customers. |

|

Proposal: General Advice ‘General advice’ should no longer be regulated as a financial service and the definition of ‘general advice’ should be removed together with the obligation to give a general advice warning. Outcome: This proposal is aimed at reducing regulatory complexity and aligning the regulatory regime with customer expectations. |

|

Proposal: Obligation to Provide Good Advice A person who provides personal advice should be required to provide ‘good advice’. ‘Good advice’ is advice that would be reasonably likely to benefit the client, having regard to the information that is available to the provider at the time the advice is provided. Outcome: This proposal is aimed at reducing regulatory complexity and burden while improving the quality of advice. |

|

Proposal: Statement of Advice Providers of personal advice to retail clients would be required to maintain complete records of the advice they provide and to provide a written record of advice to a client on request. This would replace the existing requirement for advisers to provide a statement of advice or record of advice. Outcome: This proposal is aimed at reducing regulatory complexity and burden. This is intended to reduce the cost of providing advice and subsequently increase the accessibility and affordability of financial advice without consumer detriment. |

|

Proposal: Financial Services Guide Providers of personal advice should either continue to give their clients a copy of the financial services guide or make information available to their clients on their website about their remuneration and other benefits they receive, their internal dispute resolution procedures and AFCA. This information should be available at the time the advice is provided. Outcome: This proposal is aimed at allowing advice providers more flexibility in the way they provide information to their clients. |

|

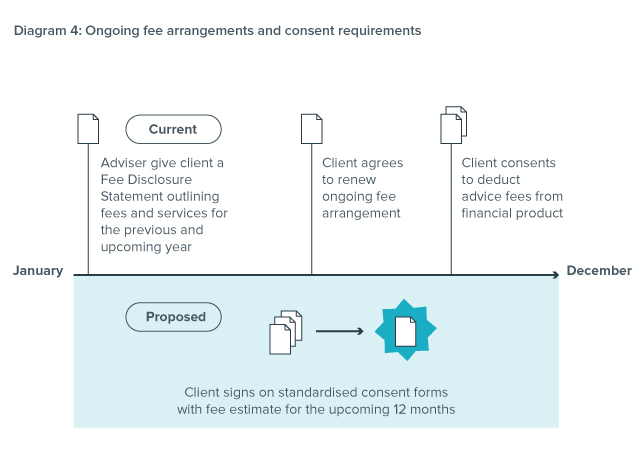

Proposal: Ongoing fee arrangements and consent requirements Fee disclosure statements should not be required. Providers of personal advice should obtain annual written consent from their client to deduct advice fees from a financial product if there is an ongoing fee arrangement. The consent form should explain the services that will be provided and the fee the adviser proposes to charge over the course of the following 12 months. Where advice fees are deducted from more than one product, a single consent form should cover each of the products issued by a product issuer. Outcome: This proposal is aimed at reducing regulatory complexity and burden. This is intended to reduce the cost of providing advice and subsequently increase the accessibility and affordability of financial advice without consumer detriment. |

How Good Advice can be applied via digital

With the triangulation of QAR proposed regulatory changes, consumer demand at an all-time high, and technological advancements enabling new digital advice models to emerge - there is a positive outlook for both the industry and businesses within it, who need to begin planning and adapting to what’s ahead.

Good Advice obligations, best interests, and the Code of Ethics are proposed to be applied to advice, whether it is provided by a human, algorithm, or digital advice service. Frictionless, digitised financial planning is a necessity of today, especially as we sit within this fourth industrial revolution, where, from Millennials to Boomers, consumer use of technology is ever expanding. We need to catch up.

85.9% of Boomers, Gen X, and Millennials view their banking online or via smartphone application at least weekly. The demand for digitisation from advice providers to access online services is in high need. This insight is contrary to conversations I hear from the adviser community, who state their Boomer clients will never log in to apps. For the record, Boomers are the largest users of Facebook, in fact, 78%, and 47% prefer to trade online.

As evidenced by various successful Robo-advice players both overseas and locally, consumers simply love participating in the augmentations of human and digital interaction. Humans want a hybrid - and this is only further reinforced with the acceleration toward digital & virtual that we've seen through the pandemic.

Today, my view is that there is a spectrum that exists around digital advice. We also require some clear reference points around the taxonomy and various models that advice businesses can adopt.

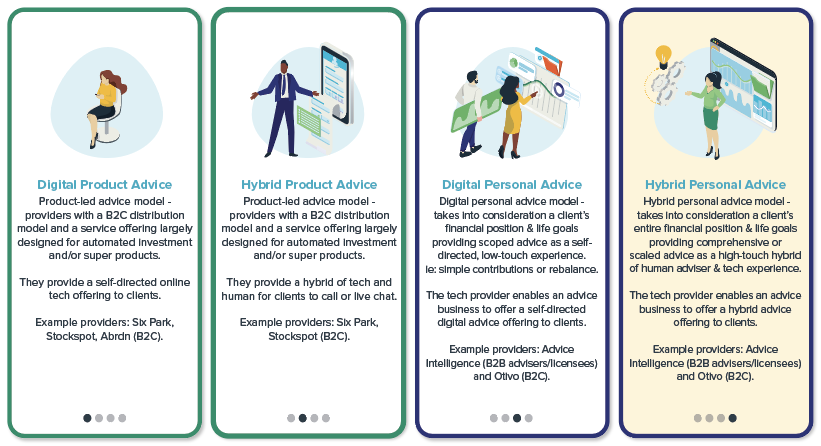

At this stage, I find that we’ve landed on four main categories of advice models:

- Digital Product Advice - product-led advice model. Providers with a B2C distribution model and a service offering largely designed for automated investment and/or super products. They provide a self-directed online tech offering to clients.

Example providers: Six Park, Stockspot, Abrdn (B2C). - Hybrid Product Advice - product-led advice model. Providers with a B2C distribution model and a service offering largely designed for automated investment and/or super products. They provide a hybrid of tech and humans for clients to call or live chat.

Example providers: Six Park, Stockspot (B2C). - Digital Personal Advice - digital personal advice model that takes into consideration a client’s financial position & life goals providing scoped advice as a self-directed, low-touch experience. ie: simple contributions or rebalance. The tech provider enables an advice business to offer a self-directed digital advice offering to clients.

Example providers: Advice Intelligence (B2B advisers/licensees) and Otivo (B2C). - Hybrid Personal Advice - hybrid personal advice model that takes into consideration a client’s entire financial position & life goals providing comprehensive or scaled advice as a high-touch hybrid of human adviser & tech experience. The tech provider enables an advice business to offer a hybrid advice offering to clients.

Example providers: Advice Intelligence (B2B advisers/licensees) and Otivo (B2C).

Technology has taken on a role that is paving a beautiful way forward in delivering financial advice to the modern smartphone-savvy consumer. These proposed regulatory changes will certainly support the financial advice and fintech community in continuing to design and enhance digital advice offerings to attain the holy grail of affordable and accessible advice to greater Australians.

If you want to learn more about how the Advice Intelligence software can support the efforts of your advice business, Book a Demo or contact us directly.