The importance of Sustainable Investing and its benefits

Humanity exists in a globally interconnected world. This reigns true from both a social and business standpoint, but even more so when recognising humanity as an integral part of our natural environment - we are mutually dependent on one another.

By nature, us humans inevitably affect our surrounding environment. We’ve devastated much of our earth’s natural landscapes and created imbalances within the natural flow and law of mother nature, including the likes of our weather systems, rivers, forests, oceans, and lands.

One-third of the world’s forests have been lost; cleared to make space for agriculture & energy production in an attempt to support the world’s ever-growing population.

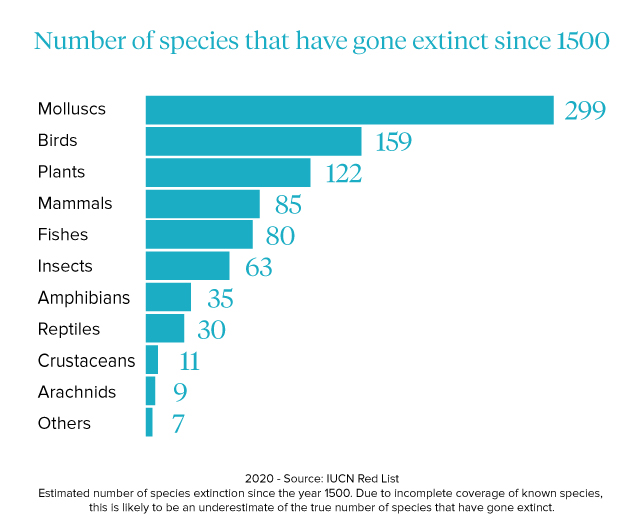

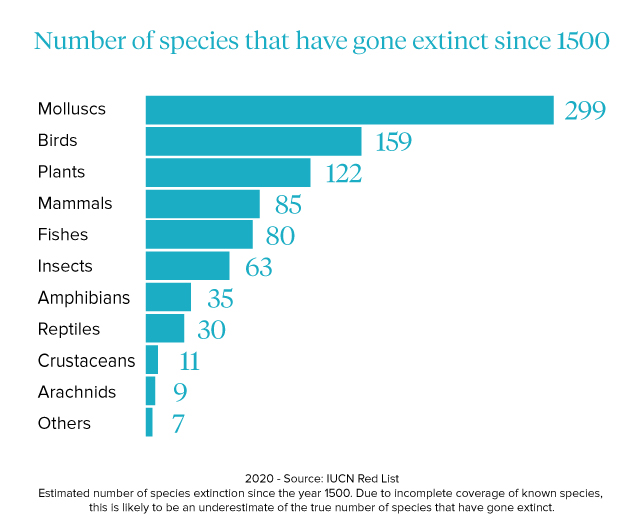

We're in the midst of the sixth mass extinction, having wiped out 60% of animal wildlife species on the planet in only the last 50 years.

Today, humanity and consciousness lie in the midst of an ethical dilemma. Though I am not here to push an ideological agenda, I recognise we are at a standpoint whereby humanity needs to make some big changes in order to move forward.

1,500 of the world's major corporations fail to be transparent about their impacts on the environment. In fact, 70% fail to disclose their forest-dependent commodities and nonrenewable energies including timber, palm oil, natural gas, coal, oil, and livestock.

The United Nations acknowledged this predicament, approving the ‘2030 Agenda for Sustainable Development', and in January 2016, the 17 Sustainable Development Goals (SDGs) officially came into force, covering the sustainability of economic growth, along with social inclusion and environmental protection. Source: Climate Action

This macro undertaking means that the entire value chain of our global economic systems needs to change. Our financial markets and policymakers animated by profit need change.

Who, what and where we invest needs to change!

This change is simple - business leaders, investors, and consumers require an increased level of attentiveness towards environmental, social, and governance (ESG) practices.

With an ever-growing awareness and demand from consumers for ethical-based, or what I refer to as values-based investing (alignment of values to investments), the adoption of ESG measures will be fundamentally important for any corporation heading towards 2030.

Fortunately, change is in motion on a global scale, with an increasing number of the world’s investors now integrating ESG ratings to understand investment risks and opportunities.

In this article, I will explore how our industry can evolve and help make these changes needed to allow humanity and our planet to thrive for future decades.

I will discuss how the application of an ESG lens over your investment recommendations for clients can provide better outcomes for all stakeholders and long-term sustainable success.

The three principal factors of Sustainable Investing for companies - Environmental, Social and Governance (ESG)

Today’s investors are seeking to diversify their portfolios with more sustainable and ethical-based investments. Traditionally, the financial ecosystem has not been entirely positioned to support this approach to ESG-based investing and advisory.

The pressures from consumers, however, are on for companies and governments to build a sustainable future. In the present information age, consumers are more savvy and knowledgeable. As we enter the largest intergenerational wealth transfer from Baby Boomers to younger generations who have inherently different ideologies and values, we, as an industry, need to be adequately prepared for the changes ahead of us.

- Gen X’s are highly motivated to invest sustainably for the future of their children,

- Millennials are outspoken and impassioned about climate change

- Gen Z’s spend more on products that have improved sustainable value

The adoption of a values-based and sustainable approach to investing, as opposed to one driven solely by profit, is required. Advancing an ESG footprint within the investment market is no longer a “nice to have” it is a “must have”, and this includes the value chain that research, rate & recommend investments.

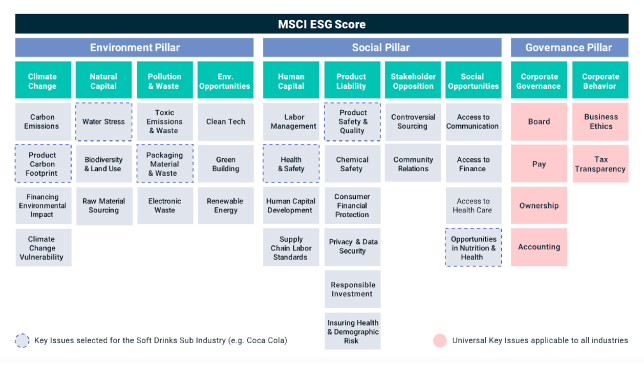

The three principles or pillars of ESG include factors quantified below:

Environmental factors

A company’s impact on the environment, such as its carbon footprint, greenhouse gases, water consumption, waste management, and energy use.

Social factors

A company’s social and labour policies and its history of complying with these. These include employee diversity, health, and wellbeing, how the company interacts with communities, supply chain standards, and customer relationships.

Governance factors

A company’s governance practices, the rules, structures, procedures, and performance measures are designed for governing its environmental and social factors. They designate a company’s responsibilities amongst its board of directors, managers, shareholders, and stakeholders.

These internal practices and policies assist in effective decision-making, risk, and compliance.

What factors make up ESG?

ESG measures provide insights into the impacts, risks, and opportunities of an organisation. They can also help to track progress toward the UN’s sustainability goals, making these transparent to build trust and attract new investors in a public forum.

ESG indicators refer to the reported factors that make up the overall ESG rating of the company. It is a system that determines where a company ranks in comparison to other companies in their industry.

The below table shows the scored areas within the three ESG pillars:

How can ESG be measured?

There are a number of methodologies that exist in measuring ESG, however, I will refer to the MSCI ESG Rating, which is a widely used rules-based methodology that identifies different industry leaders and laggards in accordance with ESG exposures and measures, then benchmarks these against their peers.

The three pillars of ESG are rated from; a leader (AAA, AA), average (A, BBB, BB) through to a laggard (B, CCC). ESG is rated across equities, fixed income, loans, funds, ETFs, and even countries.

Percentage weights are also assigned to each ESG risk in accordance with time horizon and impact. The ESG scores are combined and normalised, and then benchmarked against peers to achieve their overall ESG rating.

The below table shows the three grouped ratings:

Benefits of ESG investing

The external parallels of a worldwide pandemic, coupled with widespread climate changes have demonstrated the unforeseen risks that may impact the sustainability of the global economy. This realisation is accelerating the prioritisation of environmental and social governance amongst policymakers and investors.

To safeguard our natural resources, create socially equitable employment, and protect consumers, we need well-functioning businesses that earn fair & sustainable growth.

Barrons reported an increase in US ESG mutual fund and ETF assets, up 33% from $303 billion, to a record US $400 billion in 2021. Despite this high growth, ESG market share remains at 1.4% of the total mutual fund & ETF assets, thus there is still a long gap to bridge.

The key drivers in the bigger picture are quite simply this - ESG is a growth market, with strong consumer sentiment and demand.

We need ESG measures to keep businesses accountable in how they operate; how they impact the environment & natural capital, how they treat people and communities, how they govern themselves, and how investors can identify risks and materially compare them to their peers.

How fast are segments of sustainable investing growing?

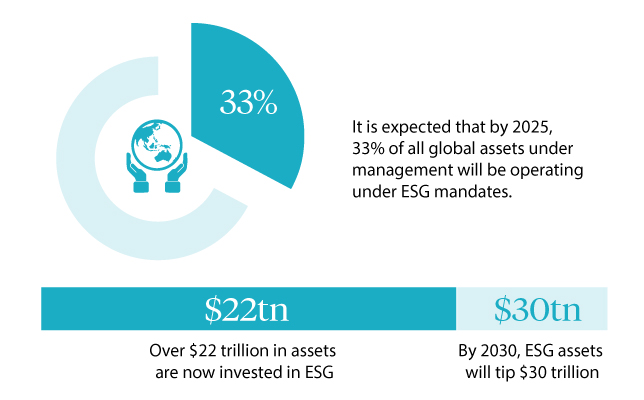

ESG is the trend of the decade, and with this in mind, ESG investing is projected to increase at a rapid rate. It is expected that by 2025, 33% of all global assets under management will be operating under ESG mandates. By 2030, ESG assets will tip $30 trillion by 2030.

Source: Sustainability Magazine

Vanguard reports that globally over $22 trillion in assets are now invested in ESG.

Source: Vanguard

These are some big numbers, confirming that ESG has moved from its infancy into the mainstream. This increase in asset prices is attracting long-term investors that want to increase their exposure to sustainable investing.

For future generations, it’s not solely about the returns, with three-quarters of Australian Millennials preferring to invest their superannuation into funds that align with their sustainable values, over simply investing to maximise financial returns.

Deloitte’s latest survey found Millennials and Gen Zs are extremely concerned about the state of the world. They have a strong desire to drive societal change, and in turn, want to invest in environmentally sustainable choices.

How do sustainable investment funds perform?

An application of ESG measures deepens the understanding of a firm’s business strategies, though this further analysis and insight have only been made possible through ESG data points. Investment managers rely on strong foresight of a company’s true intentions and future performance, and they can price risk more effectively.

A 2021

Fidelity Sustainable Investing report highlighted that there is a strong correlation between ESG and dividend growth. Those companies with a high rating on sustainability, have the highest dividend growth over the last 5 years, this growth has been over 5%. For non-ESG companies with a weaker ESG rating, the report showed they had the lowest dividend growth over the same period.

For ESG investors, this presents a positive outlook, as there is a general correlation between companies with a higher strength ESG rating and higher dividend growth in the long term.

Paying attention to ESG does not compromise returns, in fact,

McKinsey’s research has also demonstrated there is additional value created as ESG links to cash flow in five important ways:

- facilitates top-line growth,

- reduces costs,

- minimises regulatory and legal intervention,

- increases employee productivity, and

- optimises investment and capital expenditures

Interestingly, in banking & finance, an industry where consumer protection is critical, the ESG value is typically 50%- 60% on regulatory & legal costs. We just have to look within our own backyards to see the cost impact of compliance and apply some basic social governance principles.

Selecting sustainable investments

Introducing ESG to your investment mandate can benefit your clients in terms of returns, whilst also aligning strongly to the values of consumer market segments like Gen Z, Millennials, and Gen X who have a higher propensity to invest sustainably.

Advisers have various research and tools available to be able to introduce and select sustainable investments for clients. These tools traditionally are provided by research providers.

MSCI ESG Manager exemplifies an online ESG research and analytics platform that enables advisers and investment managers to understand portfolio risks, opportunities, and research analysis across the ESG pillars when selecting appropriate investment recommendations for clients.

a.i.’s software platform is also working with MSCI ESG research from within the global investment value chain. By enhancing our API to bring through ESG rating data, this platform will assist financial advisers with recommendations of ESG assets within our product comparison tool and digital SOA.

Our behaviour profiling is another useful tool that helps identify your client’s values. There are three main pillars of human values: intrinsic, extrinsic and interpersonal.

- Intrinsic values include: Honesty; Openness; Wellbeing.

- Extrinsic values include: Wealth; Status; A good future (Planet).

- Interpersonal values include: Family; Friends; Community (People)

These values can strongly influence a client’s investment choices. As an example, a client with ‘Honesty’ and ‘Community’ as their core values will unconsciously look for investments in companies that are honest and transparent and have a good social and community footprint. The impact of a client’s subconscious bias may be surprising. Therefore, by identifying your client’s values and bringing them into the investment conversation, they can strongly influence their investment decisions.

I refer to this as ‘values-based investing’. This investment philosophy and methodology can help advisers to build an investment strategy that evaluates assets on factors outside of simple returns and risk but on their own personal core values.

It also strengthens the adviser-client relationship as it deepens the level of understanding of the client.

The future of sustainable investments

The future of ESG investing is an important balance of environmental and social considerations, alongside financial returns, which emphasises a company’s true intention.

It is the balance of a company’s short-term and long-term goals, sturdy governance, and stakeholder interest that are part of a higher collective consciousness, directed towards creating a sustainable future for future generations.

If you want to learn more about how the Advice Intelligence software can support your efforts in sustainable investing as a financial planner and how to implement that into your advisory practice, book a demo or contact us directly.