At a.i., we understand financial advice plays a significant role in the wellbeing of humans.

We want to provide a new world of advice software so financial advisers can work smarter, not harder, whilst demonstrating their value, and doing so in alignment with their client’s dreams and goals.

Our mission is to unleash the true power of financial advice.

Through our software, we enable advisers to deliver beautiful advice experiences, in a way that’s cost-effective and scalable.

We empower people to make informed decisions around their finances, investments, and retirement, tailoring these to their life aspirations.

a.i. has been acquired by GBST. Read more about the acquisition in the press release.

As the market leader for Goals-Based Advice technology, we simplify the advice process, remove administrative friction, and streamline the boring bits.

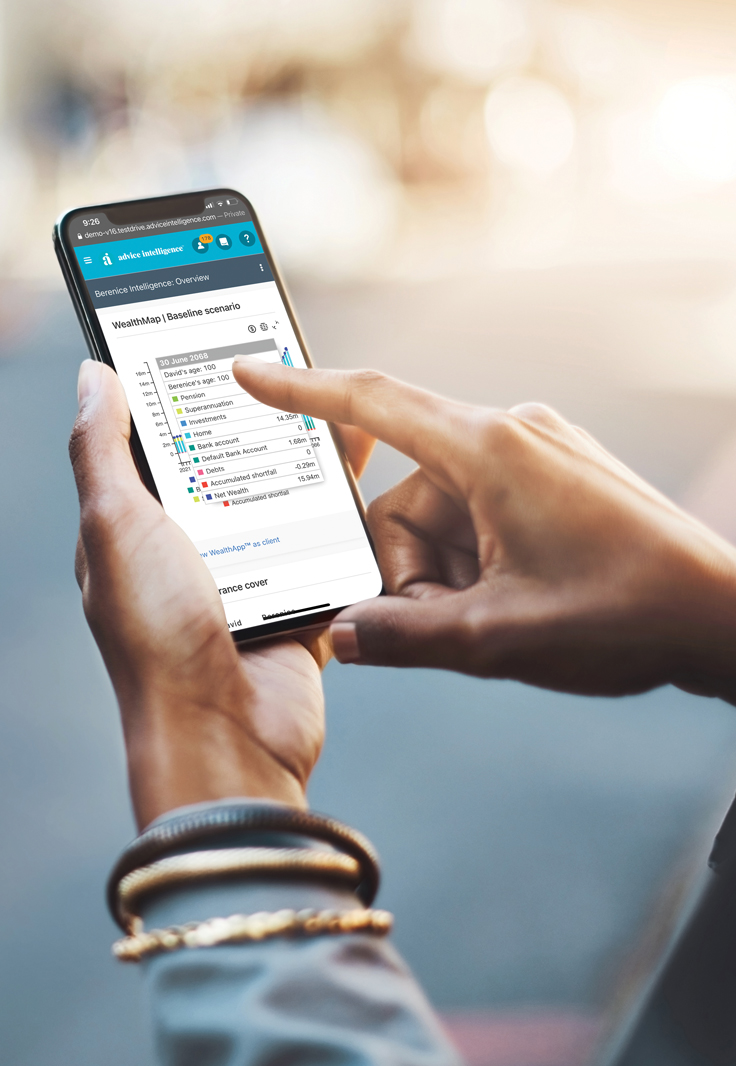

We offer our clients an end-to-end financial planning software solution. Through our thoughtful, user-friendly design we offer advisers an interface that is easy to use and implement. We enable enriched and engaged conversations between clients and advisers, so together, they can explore, problem-solve, and build future possibilities together.

Built to address industry-wide pains with legacy tech platforms, a.i. was designed by experts to create a sustainable future for financial advice businesses.

Our platform enables advice businesses to connect with other CRM & software providers, giving our clients more choice when shaping their ideal tech stack.

a.i.'s unique client-facing scenario modelling helps advisers present their advice in a visual way and articulate the value of their advice, whilst covering a wide range of strategies.

Jacqui Henderson, Founder