'A goal is a dream written down’, and 'a goal without a plan is only a dream’ - so the inspirational sayings go. Though dreams may form the basis of goals, these are negligible without discipline and guidance, especially when it comes to turning a client’s dreams into goals and setting out a robust plan to help achieve them.

What is Goals-Based Advice?

Goals-based advice comprises of many moving parts - rich conversations with your clients about their dreams and life aspirations, exploring deeper into their habits and behaviours, and reshaping their general relationship towards money.

By practising a goals-centred advice methodology, advisers can work with their clients on a more personal level and enable them to fund their goals through various financial resources, over a range of time horizons. It also allows advisers to model advice strategies and investment recommendations within specific scenarios. Advisers can help support their clients towards a better financial future, one that aligns with the goals they seek to achieve throughout the stages of their advice journey.

Goals-based advice is made up of four parts:

- Goals planning

- Goals modelling

- Goals tracking

- Goals-based investing

Let’s break down these elements.

Goals planning is the experience of exploring and setting goals with a client.

Goals modelling is the live scenario modelling experience, where an adviser can explore their client’s financial position and apply various advice strategies and trade off’s to increase the client’s goal achievability. These goals may include measures of target dollar amounts, or future cash flows at specific dates and times in the future, where funding is then prioritised by what is most important to the client.

Goals tracking is the real-time tracking of a client's goal achievability and progress over time, transforming advice from static and unmeasurable, into data-driven and dynamic, through the means of live bank account and investment data.

Goals-based investing focuses on achieving a client's goals, as opposed to a focus on outperforming markets by a percentage or benchmark. Goals-based investing allows singular or multiple investments, assets, cash flows or debt to be used to fund goals. Advisers can also utilise key levers including goal priority, amount, time horizon, funding source, risk and advice strategies to maximise their client's chances of success.

The goal of Goals-Based Advice?

All clients desire financial advice that’s easy to understand, personal, and meaningful to their lives. As an adviser, the most effective way of achieving this is through a goals-based advice experience.

By designing an advice process that positions a client’s goals front and centre, clients are regularly able to engage with the psychological component of their finances - the ‘why’ that’s driving them to succeed. In turn, this shapes an advice process that is engaging and full of purpose, improving the client’s chance of success by giving them a greater sense of control and ownership over their future. This sense of connection to their advice, through their goals, is hard to achieve with any other methodology.

So how does, goals-based advice differ from other advice practices?

Simply put, goals-based advice inherently links a client’s strategies and investments to the specific personalised outcomes, or goals, a client wants to achieve.

The Process of Goals-Based Advice

By nature, goals are outcomes-centric, and as such require clients to look towards the future and uncover what it is they want to achieve throughout their projected life journey. To support this, it helps to illustrate the probability of what a client ‘can’ or ‘cannot’ achieve based on their current financial circumstances and behaviours, and draw attention to how different what if's and trade-offs may impact their future. Once they’re in this mindset, the process of mapping these to optimal advice strategies and investment recommendations becomes a much simpler one.

As a client's behaviour also impacts the outcome of their goals, understanding their behavioural traits helps in determining what prospective blocks or motivation the client may need as part of their ongoing coaching and support.

One of the more significant challenges the industry has faced, until now, is the lack of end-to-end financial planning software available. Technology can help make goals-based advice an easy and interactive, co-creation experience for advisers and their clients. This challenge is furthered by the lack of education available regarding the behavioural, emotional, and psychological aspects encompassed in the role of an adviser.

So, how do you help your clients start the goals advice process?

According to goal-setting theorist, Edwin A Locke, the goal-setting is experienced in human psychological stages:

Cognition - this is a person's financial intelligence. People often get stuck at this stage as they don't have the language to 'talk finance', and may also lack awareness of their current financial situation. For instance, a person may live beyond their means, resulting in a constant financial deficit, or they may have a surplus, though don't know how to invest or compound.

This is the education you provide as an adviser.

Prioritisation - goal prioritisation is super important, working through what goals are essential, such as retirement planning vs a goal that is simply ‘nice to have’.

This forms part of the discovery process with the client.

Evaluate/feedback - this is where people are required to look at their current and projected financial situation and ask their adviser: what if? This evaluation process requires simulating various scenarios, answering ‘what if’s' and having 'trade-offs' conversations with the client.

This is the explore & plan part of the advice process.

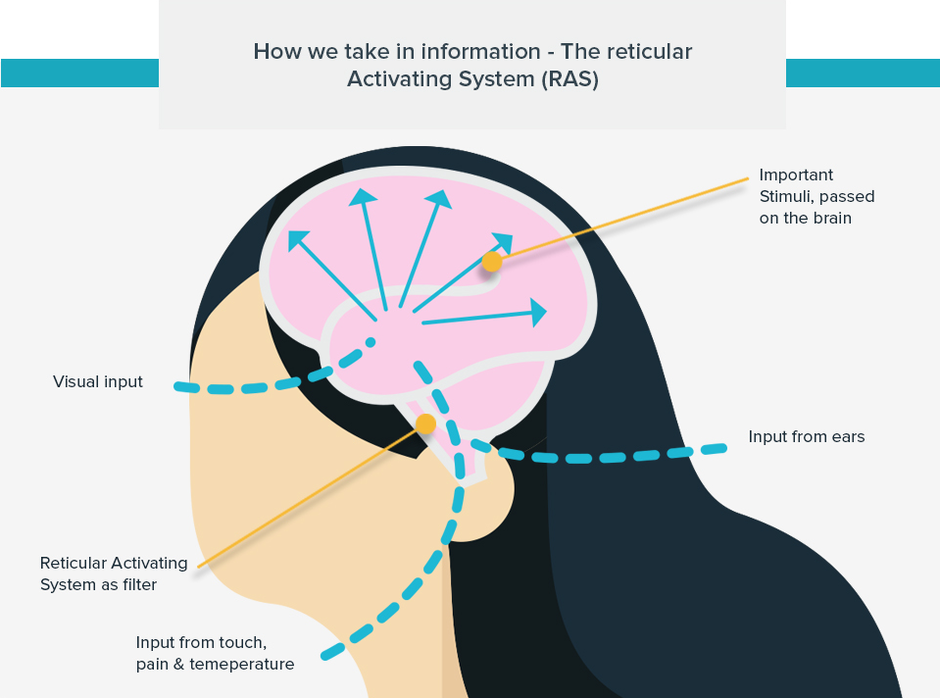

Set Intentions - once the client has clarity around their goals, and finances and a plan has been established, it is extremely important for people to set the plan as their intention. It can then become clear within the mind and the brain’s Reticular Activating System (RAS), changing the energy and quantum field.

Performance - people require a feedback loop, with positive incentives and rewards. The adviser and client can make ongoing adjustments to their plan together until the achievement of the goal is reached.

This is the ongoing review & tracking part of the advice process.

The SMART goal-setting process

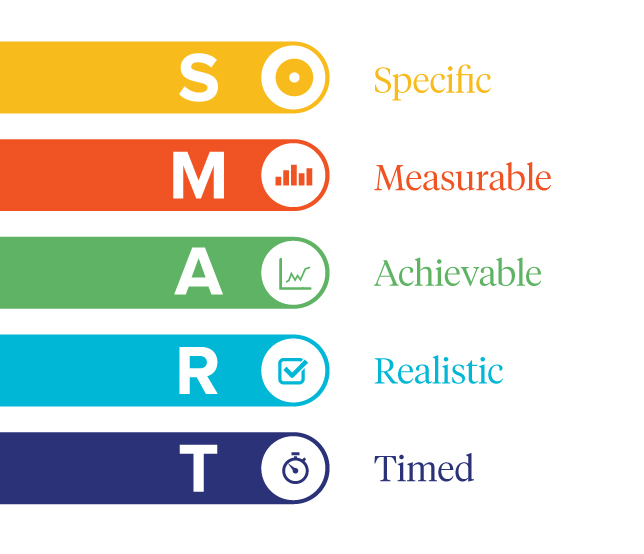

So, how do you set smart goals with your clients? This is limited to their financial plan, but also to their motivation to achieve. Though I am sure you would know about SMART goals, here is our take on this old classic:

S = Specific – What is the goal? How much is it? Why do you want it? What resources do you need and who else is involved?

M = Measurable – What is the measured outcome? How will you know when you have achieved your goal?

A = Achievable – Is it even possible? Now, or in the future?

R = Realistic – Can it be achieved by you?

T = Timed - What is the timeframe, and when do you want it?

Set meaningful goals

Remember - 75% of people don't know what their goals are, so, it’s your role as an advisor to help facilitate these conversations.

Firstly, identify your client's dreams and goals.

A useful tool during this stage of the advice process is our goals-based advice cards, which are specifically designed to help advisers deliver a stimulating interactive goals discovery conversation with clients.

Taking a similar form to a card game, this is a simple, and effective tool, and will help to draw out elements of your client’s life that are of high importance or value by prompting them to consider goals that may not be top of mind.

The goal cards work directly and in unison with the a.i. software, helping to make the initial stage of the advice process more engaging, relevant and meaningful.

To assist your goal discovery process, you can also tailor your questions toward these common life areas:

- People – goals related to people like family, kids, and your partner.

- Things – material assets like cars, boats, and nest egg.

- Places – a place you want to visit or live.

- Activities – holiday, hobby, like an adventure or holiday event.

- Information - like educating yourself or education, training, personal development, like a university course.

The more clarity a client has around their goals, the higher their chance of achieving them.

You can also utilise a.i.’s WealthMap to do a goals session and capture key data around each goal, which then gets automatically modelled, determining the clients’ goal achievability measure.

Prioritise goals

Once you’ve identified your client’s goals, you can now work together to prioritise them.

Secondly, order your client’s goals into three priority buckets, from goals that matter most to the ones that are least important.

These three buckets are:

- Non-negotiable - Essential "Must have"

- Great to have - Lifestyle “Great to have”

- Nice to have - Discretionary “Like to have one day”

Determine time horizons

Once the goals are prioritised, the date of when the client wants to achieve the goal needs to be captured, as well as the target amount they think the goal will cost. This may be a lump sum amount, an amount spread over a number of years, or an amount that requires a deposit or debt to fund the goal.

Set purposeful strategies to attain the goals

Once you’ve set, prioritised, and captured the client’s goals data, you are able to commence the modelling of advice strategies and trade-offs to help clients move closer to attaining their goals.

Modelling the client’s goal achievability alongside advice strategies is critical during this step, and due to the various complexities of modelling tax, super, strategies, cash flow and net wealth, can only be executed within a multi-dimensional engine, such as a.i’s WealthMap.

Best Technology For Financial Advisors Supported by Goals-Based Advice

A hybrid practice of human and digital is shifting the value of advice - moving away from advice that is product-led, to advice where consumer goals sit at the central apex. Consumer demand and regulators have driven this transformation, with technology innovation progressing to now support this transition, we are approaching a new realm of financial advice.

How does this technology work? In summary, a.i. developed an innovation called the WealthMap, which transforms goals-based advice into a digital, client-facing experience. By capturing a client’s goals, data and advice strategies, various scenarios can be shaped, and based on their current financial position, prompt the client to calculate their goal achievability and determine which scenario puts them in a better position.

As we move into this new realm of advice, the implementation of goals-based advice technology will promote greater advice value from the perspective of prospective clients, as well as stimulate a deepening of existing client-adviser relationships. Innovation, like a.i.’s WealthMap presents an exciting opportunity for advisers, as it is helping to articulate the true value of financial advice for potential and existing clients, making it the perfect tool in any adviser’s arsenal.

If you want to learn more about how the Advice Intelligence software can support your efforts in implementing Financial Advisor Tech, Book a Demo or contact us directly.