Retirement planning fundamentals for financial planners

Retirement can be a complex area to navigate through with clients, as at this stage of their wealth journey, their objectives are multifaceted.

Ensuring your clients have enough money saved to sustain a comfortable income, meet their ongoing essential expenses, and doing so with the flexibility to fund discretionary items or big-ticket goals such as travel or a new car is key throughout their retirement.

Robust retirement planning tools and a solid methodology provide the critical foundation for any adviser working with clients planning for the later stages of their life.

Setting retirement goals

Clients want to centre their retirement planning journey

around what is most meaningful to them, and this is done by first defining what being 'retired' means.

What lifestyle would they like to have? What goals do they want to achieve throughout their retirement years? What do they value most?

Finding the answers to these questions should always be the first step in the retirement planning process. The responses may vary in complexity, but in a lot of instances, the answers may be as simple as “I want to spend more time with family”, “I do not want to run out of money before I die” or “I want to buy a yacht and sail around the Caribbean”.

Whatever your client’s goals are, the key is to ensure they are clear, concise, and well-captured, and this is achieved by prioritising the goals conversation.

Once you have collated your client’s goals, you can work with these by allocating them into priority buckets. Here we determine what are the non-negotiables, as opposed to the nice-to-haves, establish the dollar amount of each goal, when they want to reach each of their financial goals and ascertain how they will be funded (i.e. drawing down from savings or investments).

Goals modelling tools are essential to support these conversations with clients, as these enable you to demonstrate the intangible value of your advice; how you can help them achieve their outcomes, and enhance your connection with them on a deeper emotional level.

Both successful business people and athletes often say the key to achieving their goals is having the ability to visualise them. The same principle applies to clients and their financial goals, and it is the adviser’s role to help them build a clear vision of their goals and their retirement.

Creating budgets

When retirement planning with clients, designing an income stream to support their lifestyle in retirement is the next area of focus. A consistent, dependable, and stable income is fundamental here, so it is important to commence this step by unpacking their current lifestyle and gaining a clear understanding of any expenses, taxes, debts, and assets.

A tax-effective income plan is key for clients when approaching, or inside of retirement, as it helps them to make financial decisions surrounding answers to important questions such as:

-

How much tax am I paying?

-

How will my income sources react to market volatility?

-

How long will my income last?

-

Should I transition to retirement or jump straight in?

Not all strategies will leave your clients in a better position, so having robust retirement modelling is essential when setting a budget for pre and post-retirement.

Splitting expenses into categories also helps break a client’s budget into essential vs discretionary spending. This can be achieved by following three simple steps:

-

Estimate an essential vs. discretionary expense budget

-

Deduct the essential expense budget from their maximum entitled Age Pension, this will determine the client’s secure income needs

-

Secure the client’s income stream from their investments according to their risk preferences

Risk profiling and tolerance for retirement investing

Regardless of your retirement status, every person faces investment risk. However, reaching 'retiree status' tends to prompt a shift in worldview when compared to perceptions of their pre-retirement, working self. Specifically, retirees tend to have a lower risk tolerance and greater fear around loss, resulting in a more averse approach toward investing. The impact of this risk aversion tends to also reflect in their investment returns.

This supports the importance of taking a holistic approach in retirement planning. Advisers not only look to consider traditional aspects of risk tolerance but also incorporate risk capacity, which refers to the risk a client can actually afford to take based on factors such as their net wealth and earning capacity, as well as their risk requirements (the amount of risk they need to take in order to achieve their desired return outcomes).

Another factor is a client’s goal risk tolerance, where each of their desired goals has its own risk value. For instance, the goal of retirement has a completely different risk profile to that of the goal of buying a yacht, and each goal may have its own investments underpinning it.

Superannuation strategies for retirement

There is no single strategy that takes into account all the factors required to help clients plan for retirement. In fact, many strategies that work in unison are required to attain your clients’ desired outcomes.

Strategy modelling your client’s retirement takes a multi-dimensional approach to retirement planning. Goals must be explored, client financial data reviewed, and various ‘what ifs’ examined. This supporting mechanism allows you to bring all of these elements together, to visualise, and converse with your clients in a way that they understand. This is the pièce de résistance to your advice.

There are various advice strategies used for superannuation, including but not limited to increasing super contributions through salary sacrifice, concessional or non-concessional contributions, or instead taking a slower transition to retirement via a TTR. Investing may take a ‘business as usual’ approach, extending the client's accumulation phase into their retirement phase or taking a more conservative approach, by lowering exposure to volatility for more downside protection than upside growth.

Whatever the plan, advisers need the support of digital tools to articulate the various approaches clients can take. These tools help shape and visualise what their client’s retirement will look like and depict how they can attain their retirement goals.

Investments & Asset Structure Strategies

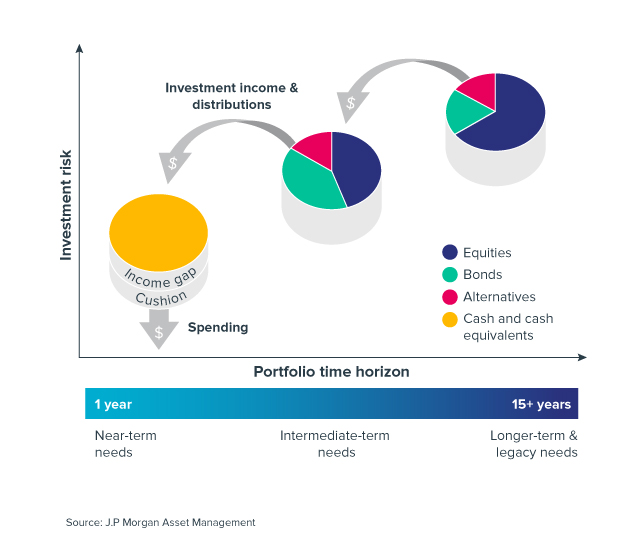

Bucketing strategy

Bucketing is a term commonly used to describe a strategy that commonly links a client's portfolio to their goals and objectives.

This looks to divide retirement portfolios into buckets to service various goals and objectives, applying certain risks over different time horizons. As an example of a simple approach to bucketing, a cash bucket and an investment bucket are set up to protect the client from market downturns, providing liquidity and a cash buffer, separate from their investment portfolio.

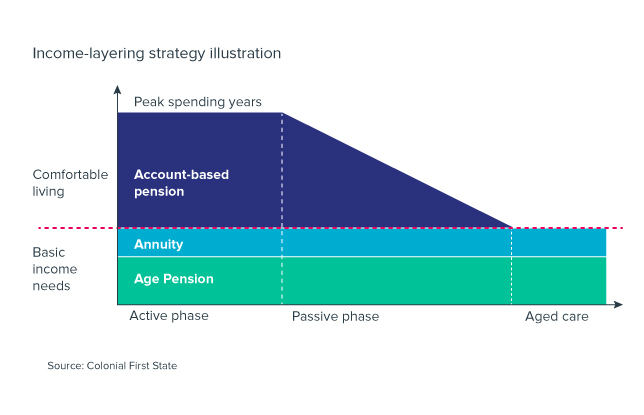

Income layering strategy

Similar to bucketing, this also takes a goals-based approach where spending is grouped into essential living expenses vs discretionary expenses, in essence, establishing needs and wants. Here, the intention is to match income, investments, and other alternative income sources accordingly against spending priorities over the clients' short and longer term. This ensures essential spending is always available from secure sources of investments, and discretionary spending is typically more freely available for investment.

Centrelink age pensions are also important facets. A retiree with no current entitlement to benefits, due to an asset test, may gain entitlement in the future as their capital decreases, and they may be able to receive a part, or full, age pension as they get older.

There are a number of factors to consider when determining which retirement strategy is most suitable for your client. To do so thoroughly, it is vital to make ensure you have access to the best retirement planning tools available, ensuring you are provided with the robust support necessary when modelling your client's retirement future.

If you want to learn more about how Advice Intelligence’s software provides advisers with advanced financial planning technology, book a demo or contact us directly.