Understanding The Importance Of Technology In Wealth Management

The wealth management value chain has been historically encumbered by digital inefficiency, leaving a predominantly negative impact on the advice process. These digital inefficiencies have created obstacles in the engagement of clients, and have inhibited the advice process to be conducted in a way that could be considered seamless, productive, or scalable.

With the mass affluent market entering the spotlight of growth opportunities for advice businesses, it is crucial to recognise the critical role of digital tools in unlocking this market potential. With this in mind, advice businesses are now starting to shift their service offerings to tackle the obstacles at play by utilising digitisation.

In order to sufficiently position their client-facing experience and back-office advice processes towards this new world of digital advice, advice businesses today must be digitally prepared with a robust tech stack.

There are many factors driving digital advice, these include:

Embracing digital into advice business models will serve existing and new markets more profitably. Accelerating this digital transformation journey will unlock the benefits of a better client experience, incorporating digital tools into advice practices to help meet the expectations of consumers, whilst simultaneously offering much faster and seamless access to advice.

The digital advice models available to these businesses are:

The implementation of digital advice technology supports businesses by improving client acquisition and retention. Digital advice enables advisers to tackle challenges that are inherent to the traditional advice process by combating the barriers to entry - lowering costs whilst improving advice accessibility and client engagement.

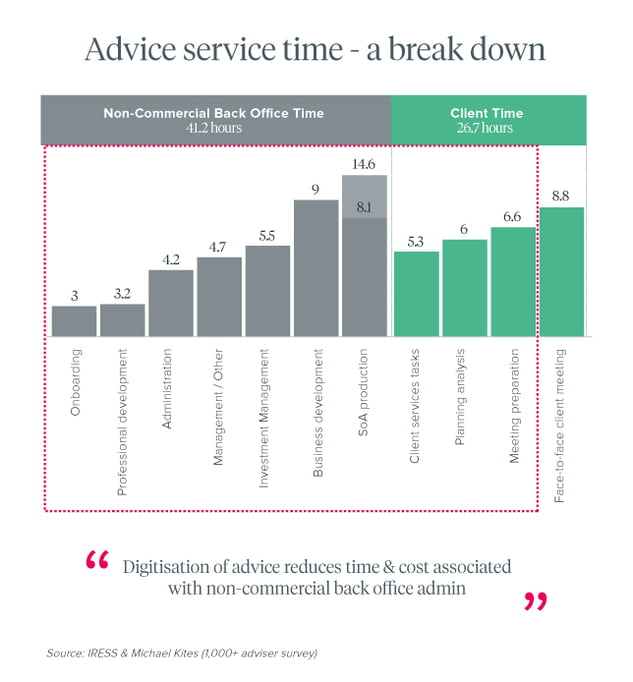

Currently, service time within the advice process is burdened by non-commercial tasks - all of which can be automated through digital advice. This time saved can then be redirected towards client-facing activities and functions, thus enhancing productivity.

Assessing Your Business Needs

Identifying your firm's goals, objectives and culture is vital for any leadership team overseeing an advice business.

The most common business goals and objectives are typically centred around numbers - increasing revenue, improving profit margins, and gaining a return on investment.

Though, business needs in relation to culture mustn’t be overlooked, and instead prioritised. The alignment of your company’s values to people is key, as this symbiosis reflects in your advice value proposition & service offering. Most importantly, the alignment of culture within a business translates to an output of value for your clients.

Both adviser retention and attracting the next generation of advisers require a tech footprint that has the ability to cater to a variety of demographics. This can be achieved by implementing a user experience that harbours some universality, and that aligns with the tech capability of people from all walks of life.

This tech footprint is not limited to your advisers, and must also cater to the needs of your end clients. All demographics, even older generations, make use of client portals and apps in their day-to-day lives and finances. Therefore, the key is in provisioning tech experiences that parallel with those they are accustomed to, and therefore comfortable engaging with.

When evaluating your current tech stack, you must also reference your team's tech capability and engage with software solutions that coordinate with your people's behavioural tech skills.

Below, we have outlined an example of an ideal tech stack for advice businesses.

When shaping your tech stack, it is worth your while to ask your tech partner about their future roadmap to ensure your business will be able to appropriately adapt to the changing technological, consumer, and regulatory environments.

Evaluating Wealth Management Software Options

There are 5 key factors to consider when evaluating wealth management software options, all of which help advice businesses in choosing the right digital advice software partner. these include:

An attempt to retrofit traditional and manual processes into new technology can impede the success of tech implementation. In order to achieve success with your tech stack, it is imperative to understand that we must relinquish habits of the past to make way for the new.

So as to determine ROI when implementing new software, advice businesses must also have an in-depth understanding of their current processes, the cost to serve clients, and the cost of software licensing.

This includes any upfront investment made into migrating data, training, and change management. The more intuitive the software, the easier the transition will be in getting staff to embrace these processes as ‘business as usual’.

ROI here can be reduced to a simple formula, being:

net gain derived from efficiency /

your cost/s

= your ROI.

Below, you’ll find an example benchmark of SoA Production ROI across two industry software providers. This can also be utilised as a guide for your own business:

Ensuring Security And Regulatory Compliance

Mounting cyber security threats coupled with the sensitive nature of client financial data in the care of financial advice businesses, it is imperative to understand the importance of cyber security compliance for your business, and the role technology can play to support your business' security. Technology has the capacity to mitigate risk and vulnerability and should be a key determining factor when choosing advice technology.

As a generalised approach, the following items should be addressed:- Assess cybersecurity risks & vulnerabilities within your business

- Consider your data security & regulatory requirements

- Consider how your software addresses cybersecurity eg: multi-factor authentication (MFA) is used for staff logins

- Consider the use of CRM and client portals to share sensitive financial data and SoAs, rather than via email where there is a vulnerability for cyber attacks.

Key Do’s And Don’ts Of Choosing Wealth Management Tools

Do’s:

Do evaluate your software options carefully. We’ve provided a solid, high-level framework to follow as a guide within this paper. Consider your business requirements, your staff, and your cybersecurity obligations. Evaluate the various software features and tools that should make up part of or all of your tech stack.

Don’ts:

Don’t overlook the importance of technology, or underutilise software features & tools once you’ve made the decision to partner with a provider. Do not select a software tool without thorough research, and don’t neglect cybersecurity and your compliance obligations.

In summary

Looking for the right software can be a minefield amongst the various providers and fintech start-ups, and sometimes features described by tech providers can be elusive as to what the software can actually do vs what it says it does.

It is important to look at your incumbent technology and understand what innovations within their tech roadmap are going to help support your business in this next wave of industry growth and the evolution of the profession.

If you want to learn more about how Advice Intelligence’s software can provide advanced technology and wealth management using goals-based advice,

book a demo or contact us directly.