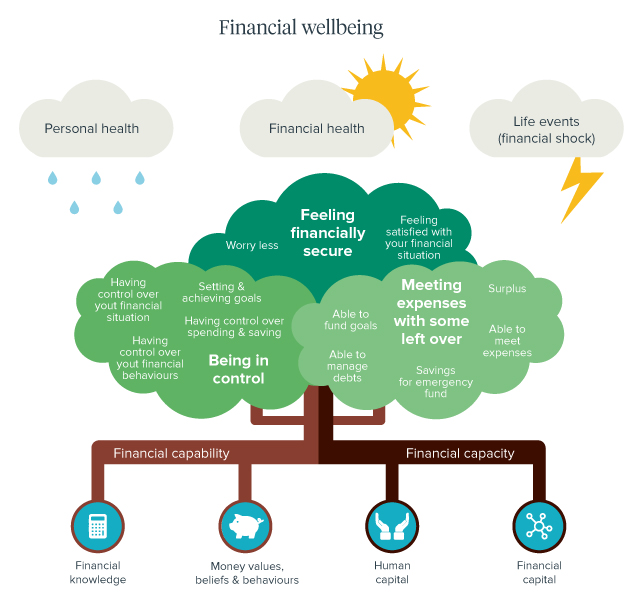

Financial wellbeing is principally linked to a person's financial capacity, financial capability, and their overall satisfaction in effectively managing their economic life towards the achievement of their life goals.

The psychological element of well-being alludes to a person feeling ‘well’ in their ‘being’. In essence, this refers to the feeling of financial security, coupled with financial freedom in both their present and future state.

Let's explore the two core elements of financial wellbeing:

1. Financial Capacity

Financial capacity refers to an individual's economic resources, mainly comprised of two elements:

- Human capital, is a person's ability to generate an income or wealth, and their level of education.

Human capital tends to decrease as we age, as our ability to learn, earn and create wealth, generally speaking, also decreases. However, our financial capital tends to increase with time, as through age we also accumulate years of opportunity towards building our net wealth. - Financial capital, a person's net wealth, is also influenced by their level of debt and savings.

Financial capital is a determinant to a person's risk capacity; the amount of risk they can take when investing. Their financial situation at any given time generally determines the amount, time horizon, and liquidity of the investment.

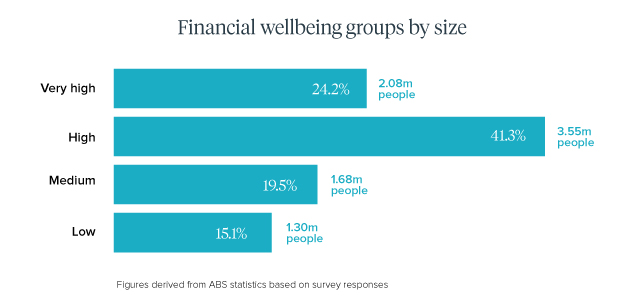

The latest ABS statistics shows the Financial Wellbeing measure by group size in the table below:

The higher Financial Wellbeing groups had little to no worries about money, and no physical or mental health issues. However, in the Low Financial Wellbeing group, 68.5% of individuals surveyed worry about money on a daily/weekly basis and more than 83.3% suffer from adverse health impacts.

The statistics showed a strong correlation between money worries, adverse physical health issues (87.1%) and adverse mental health issues (100%).

Along with the ABS data, other academic research studies on household finances and wellbeing in Australia have also concluded that higher household income, total assets, and net wealth are positively related to overall life satisfaction, whilst high debt levels have inverse associations.

An above-average household income generally has a positive impact on financial satisfaction, whereas, an income below the average statistically, negatively impacts financial satisfaction.

Ultimately, the more financial a person is in terms of assets and income, the higher their financial satisfaction, health and wellbeing are.

2. Financial Capability

Financial capability combines an individual’s financial knowledge, money values, beliefs, and behaviours. This is the psychological element of an individual’s state when it comes to feeling financially well.

- Financial knowledge is not limited to the level of education or learning an individual has when it comes to finance, but also encompasses their financial intelligence in monitoring money behaviours.

Unfortunately, most people aren't self-aware of their money behaviour or how they may emotionally to money, which makes behavioural patterns harder to identify. Psychology plays a critical part in people's finances, as it's our thoughts and mindset that frame how we approach and manage money.

Incorporating behavioural profiling of clients into the financial advice process can benefit in understanding the challenges, habits, and drivers of an individual. Traditional reasons for seeking financial advice, like investing, aside, people actually tend to seek advice because they find managing their own behaviours demanding.

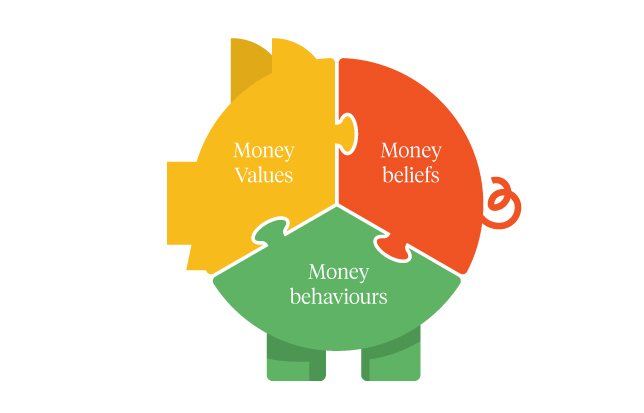

- Money values, beliefs, and behaviours form the inner mechanics of both the pathway and the achievement of financial wellbeing.

Money values stem from a person's ideals and beliefs around finances. These values form our perspectives of the roll of money plays in our day-to-day lives and how it may serve us, it can provide feelings such as freedom, power, or security.

These values drive and influence a lot of what we say, think, and do when it comes to our finances, hence our values are inextricably linked with financial outcomes, as well as our ability to achieve life goals.

Money beliefs are generally adopted from our environment or past experiences, and these tend to form the core foundations of our relationship with money. The above-mentioned academic research determined that a person's beliefs around their self-worth, if positive, can equate to higher financial satisfaction.

Money behaviours relate to the way people interact and respond to money. These psychological traits, and personality tropes, form a cognitive process that varies from person to person, and is typically defined by past experiences and role modelling.

Behaviours, such as a person's motivation, optimism, and self-control, can often impact one's relationship with money. For example, self-control is necessary to regulate any person’s money behaviours (ie: spending & saving) to assist in achieving specific goals, and optimism is important to be able to positively influence the outcome of goals.

By understanding our holistic financial capability, we can identify the ways we connect with money. We can teach ourselves to better this connection through the recreation of positive beliefs and behaviours, which in consequence, can increase our chances toward achieving our desired life outcomes.

The approach to Financial Wellbeing and common pitfalls

There are a number of factors that can lead us toward feeling unsatisfied by our financial circumstances:

- overspending

- not having enough savings

- too much unsustainable debt

- negative thoughts & feelings toward money

- lack of planning toward retirement savings, wealth protection or wealth accumulation

All of these factors can contribute to the notions within; our thoughts and behaviours. The good news is that we all have the ability to take positive action, no matter how big the problem we face, or how small the change that's required.

How financial wellbeing can be improved with Goals-Based Advice

Focusing on life goals

A goal is a dream written down, however, a goal without a plan is only a dream - a beautiful adage, but it is our dreams that shape our goals and it takes solid planning and a positive mindset to achieve goals.

Whatever your financial situation, goals setting is key for better money management and ultimately, Financial Wellbeing.

Goals are outcomes-based, future-focused and behaviourally driven. The satisfaction a person has in reaching personal milestones and achieving goals, far outweighs any attempt to outperform a market by a percentage.

Our finances need to correlate to an outcome (or a goal). As an example, an individual’s ‘retirement’ goal requires clarity around their desired retirement age, target super balance and lifestyle income. These ingredients make up the goal, and they serve as a tangible benchmark to track against over time. This action is what provides the feeling of being in control, the feeling of satisfaction, and is a crucial part of a financial adviser’s role.

The pathway toward Financial Wellbeing considers all aspects of an individual’s financial life when it comes to saving or investing, though the real magic is in how these factors relate to one's dreams, goals and outcomes they are wanting to achieve.

Match Savings Goals To Current Financial Goals

Working towards one or multiple goals requires clients to implement a regular saving plan, for both short-term, and longer-term goals. Understanding the client's goals, target amount, time frame, priority, as well as future cash flows, are essential in allocating savings to fund specific goals. These can come from either income, investments or surplus.

A clear goal, cash flow and investment plan will help align current and future savings to what is important to your client throughout their different life stages. Retirement with compulsory super guarantees and contribution strategies can help bolster retirement savings, including where funds are invested over their desired time horizon. Setting a goal as an emergency savings fund is a good defensive strategy for any unforeseen life events.

Saving strategies that link to goals are vital for any financial plan. This helps track saving balances over time and can provide clients with visibility and transparency on how they are tracking toward their goal outcome.

Prioritise and Manage Debt With Savings Goals

Paying off debt vs savings is a common trade-off with clients. Depending on the type of debt, and the type of goal the client wants to achieve, along with their desired timeframe, the choice in this trade-off can be determined in modelling these future scenarios.

Through today's tech-driven modelling, advisers are now able to produce future scenarios to aid in determining whether paying off debt or saving more, puts the client in a better financial or wellbeing position, in relation to their goal achievability.

This goals-based advice approach to your client's finances can help you strategise with clients, leading them towards less worry and a healthier mindset towards their future.

How does Financial Wellbeing relate to the pursuit of goals?

A person's financial goals stem from dreams, which are distilled down to more focused objectives - goals.

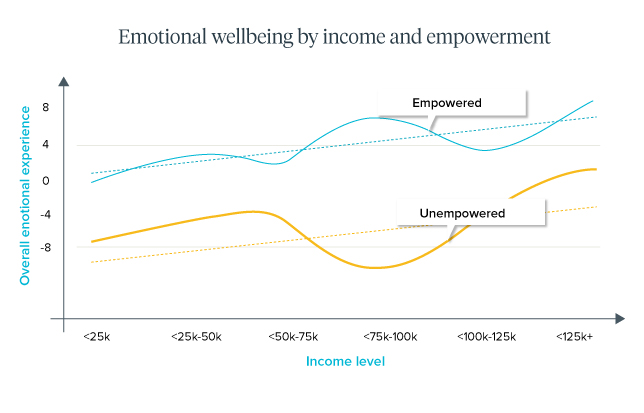

An emotional well-being study undertaken by MorningStar found people who felt more empowered in their financial lives experienced greater happiness and life satisfaction. Those who felt more dis-empowered were less satisfied.

However, this same study also identified that Financial Wellbeing provides a bridge toward achieving life goals.

However, this same study also identified that Financial Wellbeing provides a bridge toward achieving life goals.

By helping people better navigate their finances, and by improving their financial knowledge and financial intelligence (behaviour), we can empower them to take a more active role in achieving future outcomes.

The stronger the pathway toward the pursuit of goals - the greater Financial Wellbeing.

In summary, we've designed this Financial Wellbeing tree to help financial advisers visualise the elements that contribute to a person's Financial Wellbeing.

This can be used to support a holistic approach by helping clients feel better about money, themselves and achieving their dreams & life aspirations.

If you want to learn more about how the Advice Intelligence software can support your efforts in establishing financial wellbeing using goals-based advice,

Book a Demo or contact us directly.