Australia has stood to lose thousands of financial advisers, and as a result, we are witnessing an only increasing advice gap, jeopardising the needs of consumers in gaining access to financial advice.

The amalgamation of the shrinkage of the advice industry, complexities around our supply chain (advice process), consumer demand at an all-time high, more proposed changes to regulation and the rapid technological advancements of consumers, lends to a landscape in need of alignment to these factors. The situation, as I see it, is that we as an industry need to embrace new ways of operating advice businesses and redefine the value proposition and client experience around advice.

There is a need to break down the barriers that exist around consumers accessing financial advice, no matter their socioeconomic status, and broaden our reach via omnichannel delivery.

We require a shift in thinking and behaviour, to create a vision for what we want the industry to be representative of, and to focus on what will help bolster consumer accessibility, and also sentiment around wealth management.

The demand for financial advisers is on the rise

The high demand for advice spans all generations, with today’s consumers having a strong focus on creating wealth and striving to live their best life. Consumers are seeking advice designed around their goals and life aspirations.

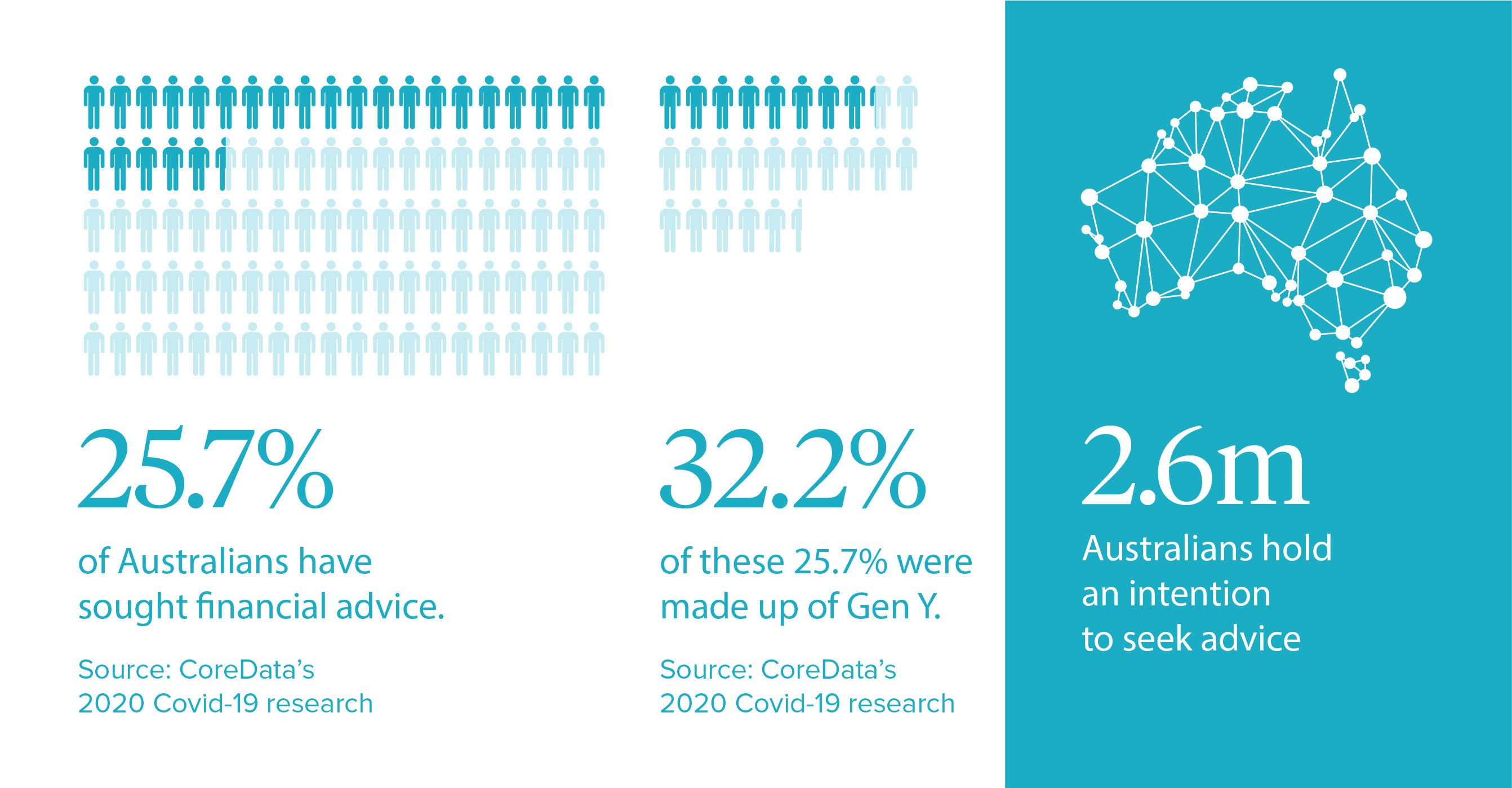

CoreData revealed that 25.7% of Australians have received financial advice, and Investment Trends found 2.6 million Australians hold an intention to seek advice. As we are seeing younger generations with an earlier interest in investing, one in four of those Australians (32.2%) is made up of Gen Y’s.

With the average number of clients an adviser services at 128, the average number of clients they see a week at 6.1, and the current number of advisers sitting at 16,671, there is very little chance this industry can service this volume of demand, let alone design millions of tailored advice experiences around an individual's own unique life goals.

So what is the answer to this demand vs supply equation we face?

How financial advisers can meet the new demand for Financial Advice

The only answer to solving our demand vs supply conundrum is to remove the friction from what has become an antiquated advice process, from delivering advice via paper, PDF’s and SoA’s, and transforming the advice process toward one that is client-centric, data-driven, real-time and dynamic - leveraging digital to create efficiencies and scale.

Technological advancements of AdviceTech today are enabling this transition toward a more streamlined and cost-effective advice process - one that’s designed around the consumer and the unique, tangible outcomes they're seeking to achieve, or targeting the specific problems that require a narrower scope.

a.i.'s WealthMap, as an example, digitises the end-to-end advice process, from client engagement and data capture, to live scenario modelling and instant, digital SoA production. The beauty of the technology is that advisers can model various future scenarios for a client, and benchmark them to determine the best outcome in relation to their life goals. It automatically builds the SoA in the background to produce advice instantly and digitally to the client's own portal for digital sign-off.

However, the adoption of this type of technology requires a shift in behaviour, creating a new mode of operation whereby advisers leverage tech tools that work for them. These tools become part of the client conversation, reorders the way paraplanning is performed and redesigns the incumbent manual advice process.

So, rather than assuming that advice technology needs to fit into the antiquated, traditional, and quite manual advice process, it is time to start thinking that your advice business needs to start moulding toward a more modern, digital and efficient advice process, whilst still maintaining core components of the old ways.

Greater engagement is required between advisers and clients

Advisers want more time spent with clients - it is how they sustain long-term relationships and keep their clients engaged throughout their advice journey.

Financial advice is an industry built upon the foundation of a longer-term time horizon. Keeping clients engaged over time is an important component in maintaining the longevity of mutually beneficial and enduring client relationships.

Understand your clients' expectations

Managing a client's wealth is hyper-personalised, and the advice process is one that involves managing a client's emotions, family dynamics, and life aspirations, all of which encompass both the good times and hard times in a person’s life. At its core, financial advice is about deeply and intimately understanding clients.

Technology is able to enhance these personal aspects of an advisory relationship. As humans, we’ve transitioned into a world of smartphones, life apps and instant gratification, and today’s consumer now expects service experiences that combine the elements of human and tech. Consumers seek all the human elements that a financial adviser brings - the connection, relationship and validation around important financial and life decisions. But, they also require other elements that can be delivered via technology, such as their financial data and advice being dynamically tracked to their goals and investments.

As the rate of consumer technology adoption has surpassed the technological innovation of this industry, it is now overdue to bridge the gap between the way consumers use tech and the way we deliver wealth services, as a new hybrid model is now what clients expect.

If we look at the 10-20 year advice relationship advisers have with their clients, the facet that creates the strongest long-term bond is the human element. However, as we move forward within this next Industrial Revolution (Industry 4.0) and certainly with younger generations, who are the recipients of this next wealth transfer, it is those advisory businesses that can deliver a hybrid of human and tech that will have the most competitive edge, and provide a far superior financial advice experience to clients.

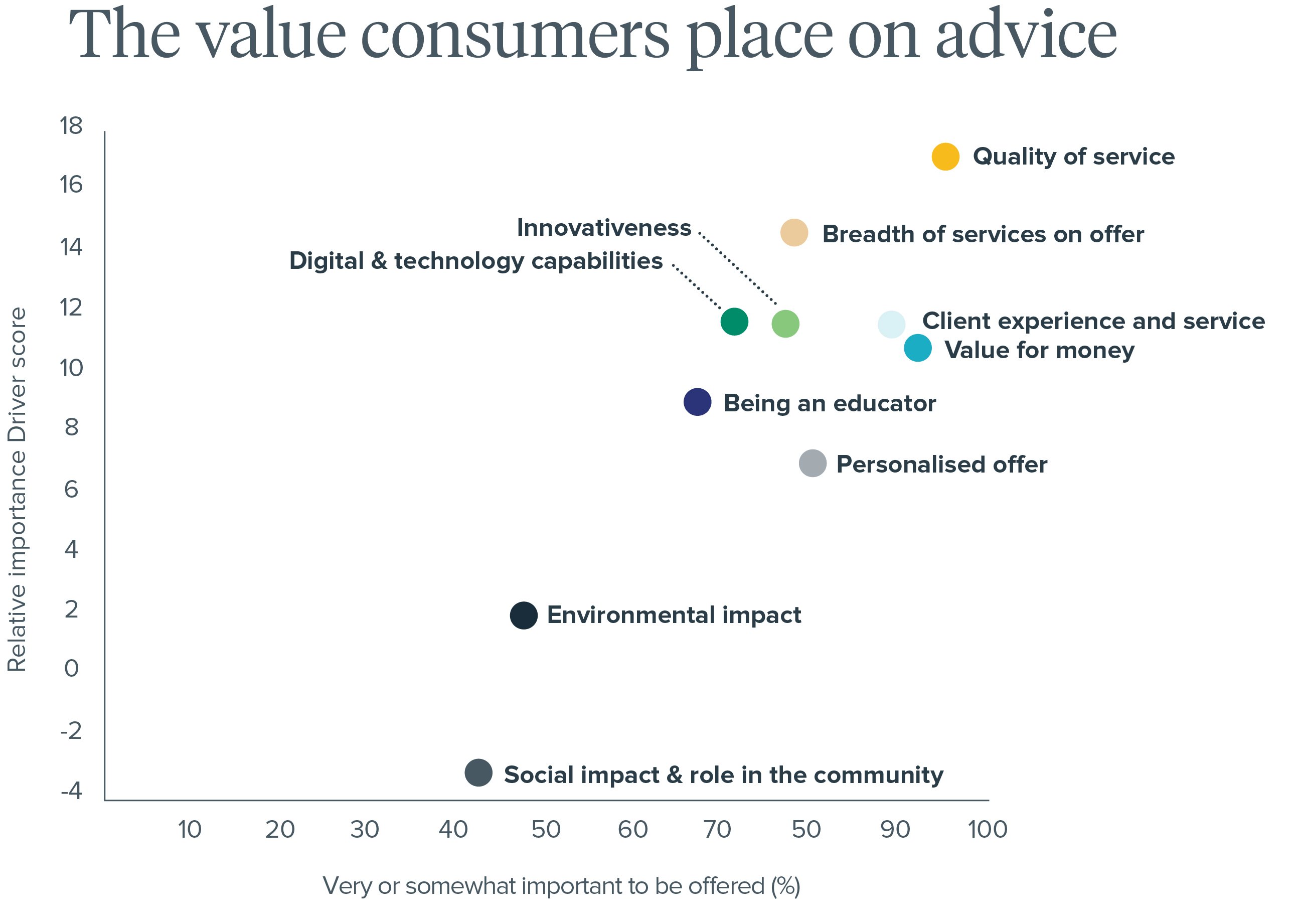

In the latest Netwealth report, consumers place the most amount of value on advice that demonstrates innovativeness, digital & tech capability, and a heightened client experience.

Define your ideal client's needs

Before the digital revolution, consumers were satisfied with basic experiences when purchasing products and services. However, nowadays, they have an expectation for these experiences to be simple, personal, seamless and engaging. The level of consumer expectation around ‘customer experience' is increasing, with technological growth being the driving force behind this trend.

Today’s advisable client has a need to engage more seamlessly with the financial advice process, especially at the beginning of the advice journey when capturing client data. This is where advisers experience a significant dropout rate, meaning an opportunity loss before the advice process even begins. If the consumer makes it to the next stage in the advice process and proceeds with an SoA, this SoA is typically presented in a language and format that consumers simply struggle to understand, let alone engage with.

Advice needs to be an experience that inspires, is hyper-personalised and engages clients to want to pursue, this is where technology can assist advisers. As described above, our WealthMap experience can model various scenarios and options, live in front of clients, which can help them to understand their advice and its inherent value, but more importantly, aid them in making informed life decisions in relation to the financial outcome they are seeking (their goals). Further on from this, they are able to track their advice toward these outcomes from their mobile app, yet with traditional static paper-based SoAs - this is not achievable.

Consumer demand is driving the industry into the realm of data-driven financial plans, powered by transactional bank and investment data, which can dynamically track a client's goals, investments and advice strategies transparently. This only brings us closer to client expectations in a world of life apps, helping to strengthen the adviser-client bond, as tech continues to enable more seamless collaboration and communication.

Keeping Clients Engaged During Market Downturns.

With a goals-based approach to investing, clients can look forward to positioning their investments against their goal outcomes and time horizon, rather than outperforming markets. This helps to lessen the required management of client worries around market downturns, as the primary focus in the advice journey becomes centred around achieving specific goals, not percentages and benchmarks. Advisers can more accurately monitor the progress of a client’s goals back to the achievement target, which has flexibility around adjusting target sum amounts, time-horizon, priority, and asset allocation can be more tailored.

As an industry, we are on the precipice of an era of advice unlike one we’ve ever seen before. By engaging technology and shifting our thinking advisers can have the capacity to service the growing market demand in a way that builds accessibility, enhances value, and strengthens advice relationships.

If you want to learn more about how the Advice Intelligence software can support your advice business Book a Demo or contact us directly.